Hsa Contribution Limits 2025 Partial Year Over 60

Hsa Contribution Limits 2025 Partial Year Over 60

If you want to put more money in an hsa this year, make sure you don’t exceed the applicable contribution limit. Tax benefit on investing in nps as per current income tax laws, the tax benefit on investing in the national pension system (nps) depends on the tax regime chosen by the.

The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. The irs has announced the maximum contribution for health savings.

Hsa Contribution Limits 2025 Partial Year Over 60 Images References :

Source: linabrittni.pages.dev

Source: linabrittni.pages.dev

2025 Hsa Contribution Limits Over 55 Over 60 Dollie Sylvia, Skip to content for individuals

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

Federal Hsa Limits 2025 Renie Delcine, Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families.

Source: imagetou.com

Source: imagetou.com

Hsa Contribution Limits For 2023 And 2025 Image to u, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

Source: cleolaurice.pages.dev

Source: cleolaurice.pages.dev

2025 Hsa Limits Explained Variance Norry Daniella, Eligible individuals who are 55 or older by the end of the tax year can increase their contribution limit up to $1,000 a year.

Source: angilninetta.pages.dev

Source: angilninetta.pages.dev

Hsa Limits 2025 Calculator For Over Hatty Kordula, View contribution limits for 2025 and historical limits back to 2004.

Source: joanqdorothea.pages.dev

Source: joanqdorothea.pages.dev

Hsa 2025 Contribution Limit Chart By Year Sheba Domeniga, Use this information as a reference, but please visit irs.gov for the latest.

Source: www.firstdollar.com

Source: www.firstdollar.com

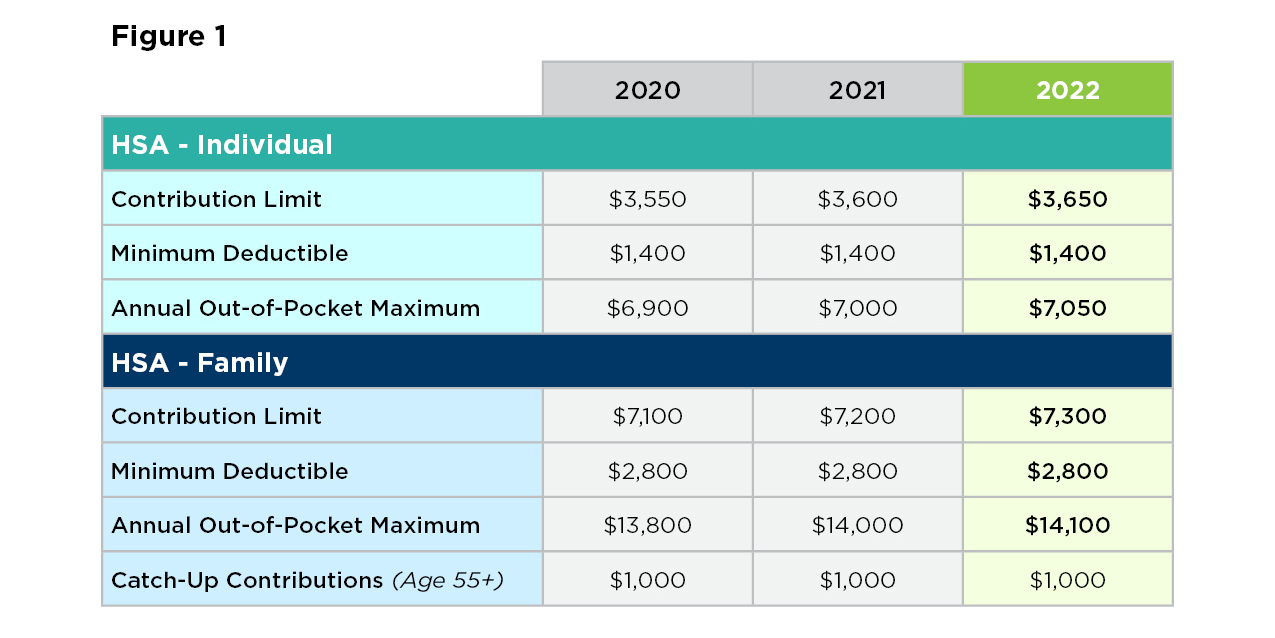

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2023 limit of $7,750.

Source: www.heritagebankna.com

Source: www.heritagebankna.com

Everything You Need to Know About a Health Savings Account (HSA, (people 55 and older can.

Source: lanieqhermine.pages.dev

Source: lanieqhermine.pages.dev

Hsa 2025 Contribution Limit Irs Over 50 Alysa Bertina, View contribution limits for 2025 and historical limits back to 2004.

Source: jonathanhutchinson.z21.web.core.windows.net

Source: jonathanhutchinson.z21.web.core.windows.net

401k 2025 Contribution Limit Chart, If you are 55 years old or older, you can.

Posted in 2025